APN Results – A Net Loss but ARN still performing

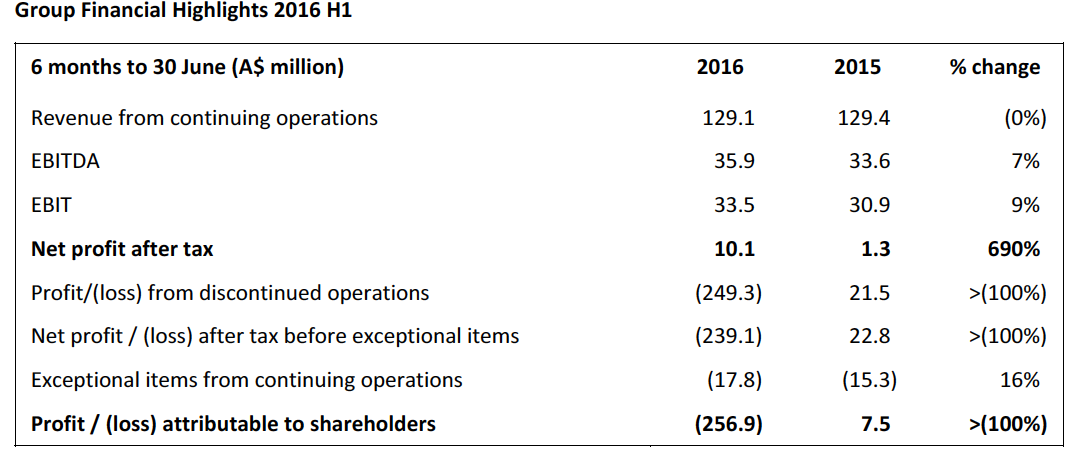

APN the parent of ARN and iHeartRadio Australia have released half-yearly figures – clocking up a net loss of $256.9 million for the six months through to June. Net Profit After Tax is up , ARN still performs as the company positions for future growth.

APN Chairman Peter Cosgrove said: “APN has delivered a solid result with higher earnings in a competitive media market. Most importantly we have moved a long way towards transforming APN into a radio and outdoor media company, which are both growth sectors in the media industry in Australia. We have also positioned APN well for the future by paying down a significant proportion of the Company’s debt, and now have the right capital structure to pursue growth.”

“Today’s result and the significant turnaround of APN is a credit to the extended APN team.”

Australian Radio Network Key highlights:

- Secured 5‐year contracts with Kyle & Jackie O: loss of revenue risk eliminated

- Survey 5 ratings improvement:

- 6% national share gain

- KIIS 1065 ahead of 2015 performance

- WSFM +1.4 share points

- #1FM station in Melbourne – GOLD 104.3

- KIIS 101.1 good growth in Breakfast o Adelaide #1 station

- Perth audience levels at pre‐acquisition levels

- Significant growth in ARN digital audiences, including 53% increase in mobile listening hours to ARN stations through iHeartRadio.

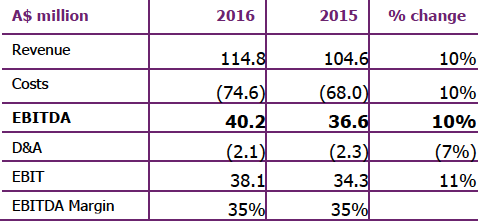

ARN Revenue:

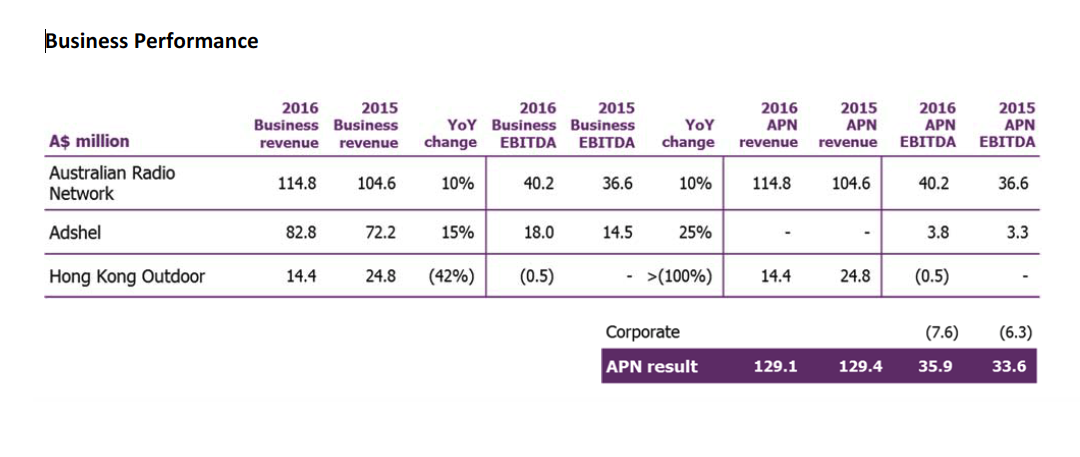

In a radio market that grew 7.2 per cent, ARN advertising, Emotive and other revenues grew 10% to $114.8m, while EBITDA grew 10 per cent to $40.2m. Cost growth of $5.1m (7 per cent) was primarily attributable to revenue‐related cost of sales and the full period cost impact of H1 2015 investments, with the remaining cost growth around 3‐4 per cent. Margins were maintained at 35%.

APN CEO Ciaran Davis said: “The progress made to date has been substantial as we enter into the next phase of our development – that is, a relentless focus on driving our core businesses, complemented by our search for investment opportunities that fit with our strategic pillars and deliver increased shareholder value. Finally, we will be working harder and closer together as an integrated APN group to derive revenue and cost synergies across the board.”

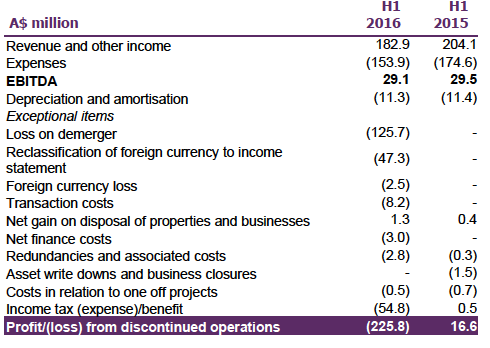

Meanwhile NZME has been listed as discontinued operation but they have listed the loss on the demerger. Calculations are based on the average price of NZME shares over the first 5 days of trading post demerger. They also carried some Tax expenses which includes the write-off of historical tax losses (A$58m) and NZME share of NZ IRD tax settlement (A$15.7m), offset by a write-back of deferred tax on intangibles (A$11.7m) and other demerger related adjustments

NZME:

What’s Ahead for APN: