MRN shareholders vote yes to merger with Fairfax

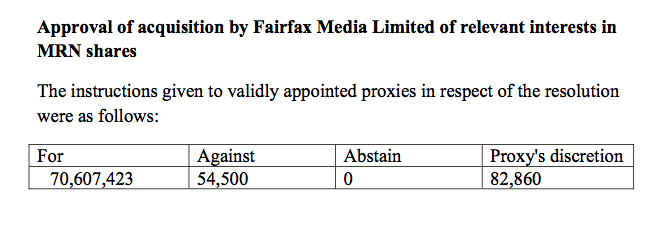

Macquarie Radio Network shareholders have, as expected, voted overwhelmingly in favour of the merger with Fairfax Radio Network this morning at an extraordinary general meeting.

At the meeting Fairfax formally confirmed their two nominees to the new board were Greg Hywood and James Millar.

Speaking at the meeting, Macquarie Chairman Russell Tate said, in part;

|

On 22 December 2014, MRN announced the proposed merger between MRN and Fairfax Radio Network, FRN (Proposed Transaction). Under the Proposed Transaction, MRN will acquire 100% of the issued share capital of FRN in exchange for the issuance of new MRN Shares to Fairfax and an equalising cash payment to Fairfax of approximately $18 million based on the net debt positions of FRN and MRN. On completion, existing MRN shareholders will hold 45.5% and Fairfax will hold the remaining 54.5% of MRN shares on issue. The proposed ‘merger of equals’ brings together Australia’s leading news-talk radio operations which currently occupy number one overall ratings positions in Sydney (MRN’s 2GB) and Melbourne (Fairfax’s 3AW). The combined group will consolidate the operations of an additional five radio stations across Australia: 2UE (Sydney), Magic 1278 (Melbourne), 4BC (Brisbane), Magic 882 (Brisbane) and 6PR (Perth) and also includes two additional radio businesses, Satellite Music Australia and Fairfax Radio Syndication. As part of the proposed transaction and due to regulatory requirements, MRN is required to divest 2CH and Macquarie Regional Radio network. I will lead the merged operations as Executive Chairman for an interim 12 months supported by Adam Lang, currently FRN’s Managing Director, who will be appointed Chief Operating Officer. The Board will comprise Jack Singleton, myself, two Fairfax nominees, Greg Hywood and James Millar, and one yet to be determined independent Director, who is expected to be appointed shortly after completion, subject to ACMA approval being received. This means that, as at completion of the proposed transaction, assuming it is approved, each of Kate Thompson, Maureen Plavsic and Max Donnelly will step down from the Board. I would like to thank each of them for their service to MRN over the years. The Directors believe that significant benefits will be delivered from the proposed transaction, including:

Each of John Singleton and the Carnegie family, as the major and substantial Shareholders of MRN, have indicated that they will support the proposed transaction and constitution amendment and vote in favour of them, assuming the various conditions in the MIA are satisfied and no superior proposal is received. I note that since announcement of the proposed merger on 21 December 2014, four months ago, no alternative proposal has emerged. I also note that approval for the proposed transaction has been received from the ACCC and ACMA, Fairfax’s Radio 96FM has been sold, no material adverse change to the business, assets, liabilities, financial, trading position, profitability or prospects for either MRN or FRN has occurred or is likely to occur before completion of the proposed transaction and there has been no ‘prescribed occurrence’ in relation to the MRN Group (except for Macquarie Regional Radio and Radio 2CH) or FRN Group. Accordingly, we expect all other conditions precedent to be satisfied subject to the transaction being approved by MRN Shareholders. |