Strategy Playbook: #1 Ratings Realities

In this new series I'll go behind the scenes, to reveal the practical fundamentals of building a successful programming strategy.

In commercial radio, content success is ultimately benchmarked by ratings. So a core understanding of the methodology and how to play to it is the essential Step 1.

In Australia and NZ metros (and NZ provincial) that means diary-keeping. New in regional Australia this year it's telephone surveys*.

Both techniques are robust, as are people-meters. Whichever way, radio listening, is forever challenging to measure because of its strengths of free access, mobility and content-surfing.

I also recommend downloading the excellent GFK 2014 Radio Ratings Tool Kit, under Resources, for more background on the new Australian metro surveys, and a refresher for all of us on how the ratings actually work. Despite all the emotion, it's all really quite logical! You get what you earn.

I also recommend downloading the excellent GFK 2014 Radio Ratings Tool Kit, under Resources, for more background on the new Australian metro surveys, and a refresher for all of us on how the ratings actually work. Despite all the emotion, it's all really quite logical! You get what you earn.

The key strategic question is …

How to maximise your chances (and there are aspects of a lottery about this!), of gathering those vital station stickers and quarter-hour crosses in diaries, or Cume & Station Most recall on the phone?

Why Cume matters … like really matters

In all radio research.

It's a numbers game, as in number of diaries/phone interviews with at least one occasion of listening for your station, which is your Cume (Cumulative audience or Reach) figure.

It's the absolute foundation of your strategy, before you even contemplate improving TSL & Share.

Scary Cume Maths

Scary in implications, not the calculation :). Here's a simple, fictitious example of diary – survey reality, as it might apply to a metro market …

• Survey sample size 2000 … sounds good – it's a lot of people, but…?

• Station A has 500,000 individual cume listeners 10yrs +, Station B 300,000, Station C 150,000

• The total Cume listening to any radio, at least once during the survey period could be 1,700,000

• So as a percentage of the total cume: Stn A = 29.4%, Stn B = 17.6%, Stn C = 8.8%

Note: everyone gets excited about Cume in thousands, because it represents actual people. But the Cume % is just as critical, and more objective, at the very least because the total market Cume can fluctuate up and down.

• Apply that percentage to the sample size, to find how many physical diaries had any mention of you … Stn A = 588 diaries, Stn B = 352, Stn C = 176

• So in terms of who has the best odds in the game, Stn A is by far in the strongest position, and Stn C has much less chance of making an impact. Stn B not bad, can try harder.

• The major problem for Stn C right from the start, is no matter how great the content, it's never going to make real progress until it attracts more Cume … and the right type of Cume. Why?

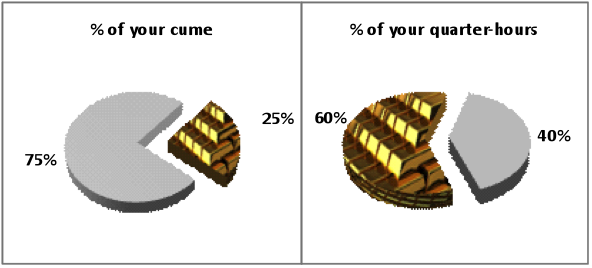

Not All Cume is Equal

• Those 176 diaries will be a mixture of very-heavy (but only if the content is great) through to very – light listeners.

• i.e. P1s (loyals and exclusives) who will give you most, if not all, of their quarter-hour crosses, plus regular P2s (secondaries), and those few, lonely mentions based on very occasional listening.

• A station in trouble with weak content & marketing, will have more light listeners, and fewer heavy listeners. and low TSL/Share along with the smaller Cume. At least if your content is on the right track, you have a chance of extracting more TSL value from your diary-keepers.

• A further reality check is to divide the number of "station-diaries" by the number of weeks in the survey … in this case Stn C's 176 theoretically represents about 17 (10yrs+) diaries per week of a 10 week survey. e.g. .0009% of a 1,800,000 population that you're trying to influence.

• Slice & dice those weekly 17 diaries into narrower age targets and heavy vs. light, and there's only a tiny, single-figure group of people who have your fate in their hands!

• Yes, that extra burst of contesting in the last week of survey will certainly make a big difference … really???

• Stn A's 588 diaries (58 per week) give it much more clout in the survey system, especially with more heavy diary-keepers in play.

Strategy Playbook Recommendations

#1 Objective: is Cume-building with year-round external marketing, in a form that suits your target lifestyle. The budget that's unfortunately often first to go in belt-tightening, and yet the most essential. So don't blame the methodology if you lose Cume, it's your responsibility to grow and maintain it.

Strong content, especially at breakfast, can obviously build Cume through channel-surfing, and is also why tight music rotations are effective (a whole other topic!). But the risk over time is increasingly preaching to the converted, and losing the methodology game, by not regenerating new listeners.

Target Cume-building to breakfast & heavy listeners in your demo, psychographics and format category. This is the fun part as it gives you the mandate not to be a bland commodity, by diluting your content for a broader passive audience. Instead being active fan-oriented, and taking creative risks. More here.

Best practice radio thinking is not "all things to all people", but "lose some to win some". If the super-core format fans don't at least Cume you, that's a big problem!

Heat up survey activity at least 2 weeks before the diaries are placed or telephone interviews commence. The first day of survey is way too late to affect that small circle of your listeners who are contacted, or even more futile, to attract new Cume.

Truth is, the habitual listening that ultimately drives your research performance is built months, even years before.

Kyle & Jackie O are new to the KIIS 1065 frequency, but not to the market. They are their own distinct brand, that transcends the station cume patterns, with their own long-term listening habits. See also my Cue-Routine-Reward Loop article.

And, their Cume converts into not only breakfast share, but also daytime. If you were able to look at individual diaries, you would see how a large percentage of daytime-location diary-keeping such as workplace , starts during breakfast. I've seen for myself, how so many long columns of at-work TSL crosses kick off there.

"Win breakfast, win the day" maybe a cliché, but it's backed by hard evidence.

Next time, my Strategy Playbook #2 will address Content-Cume vs. Passive-Habit.

* The research companies approved to conduct the surveys (by telephone) in regional markets outside of the Gold Coast, Canberra and Newcastle markets are: Xtra Research, DBM Consultants, Enterprise Marketing and Research Services (EMRS) and IRIS Research.

Eriks Celmins is Managing Director of Third Wave Media and InsiderFocus, consultant for research, strategy and content. Find out more here.