Everything you wanted to know about online radio and streamers but were afraid to ask

I was talking to a friend of mine the other day and he asked: “Does anyone actually listen to the radio anymore, except in the car?”

He’s 34 years old!

Of course they do, and recent research shows the use of radio is as high with millennials as it is with boomers, but online, personalised radio and streamers have firmly been adopted by younger demos.

Now, the over 35s are exploring this exciting world that has taken its place in the radio landscape. Online radio platforms create endless possibilities for both radio companies and listeners. There’s plenty of hype around these services, but it is still early days.

I’ve used most of these for quite a while, but so far none have really stuck with me for long, apart from some brand loyalty to Apple’s iTunes, Pandora, Spotify and, more recently, iHeart. So, it’s worth checking out their progress to see where they’re up to in 2014.

Generally, the services deliver three types of product to users: personalised radio, where you can create your own playlists; streaming terrestrial or internet radio; and digital download sales.

Generally, the services deliver three types of product to users: personalised radio, where you can create your own playlists; streaming terrestrial or internet radio; and digital download sales.

Music streaming has been in existence since the early 90s, at the time the World Wide Web was launched (20 years ago in 1994).

.jpg) The first major digital download music service Napster, which was purely downloads, started in 2000. Pandora, a true streaming service also launched in 2000 (Australia in 2012) and iTunes, which was downloads only until iRadio came along this year, was launched in the early 2000s.

The first major digital download music service Napster, which was purely downloads, started in 2000. Pandora, a true streaming service also launched in 2000 (Australia in 2012) and iTunes, which was downloads only until iRadio came along this year, was launched in the early 2000s.

Personal radio platforms describe themselves like this: when you listen to the radio, you're listening on someone else's terms. They control the music, they control the content and they control what you hear. Whereas personal platforms give you the power to create your own personal station or playlists where you can select your favourite radio shows and choose the music.

The arrival of these services is not as significant a shift as when the iPod was launched, which had a major impact, being the first opportunity to create your own digital playlists.

The big three radio companies here in Australia, Southern Cross Austereo, Australian Radio Network and Nova Entertainment, have all ventured into online radio platforms. They've either invested in or licensed online radio brands and streaming services. It’s now worth reviewing to see how they are going and how they compare to other digital music services.

.jpg) iHeart – Australian Radio Network: Features personalised radio, streaming and aggregates ARN (and Clear Channel) radio brands. ARN recently signed a 10 year licence with Clear Channel’s iHeart. It was founded in 2008 and has over 30 million users. It's a free service and is number two with a 9% share.*

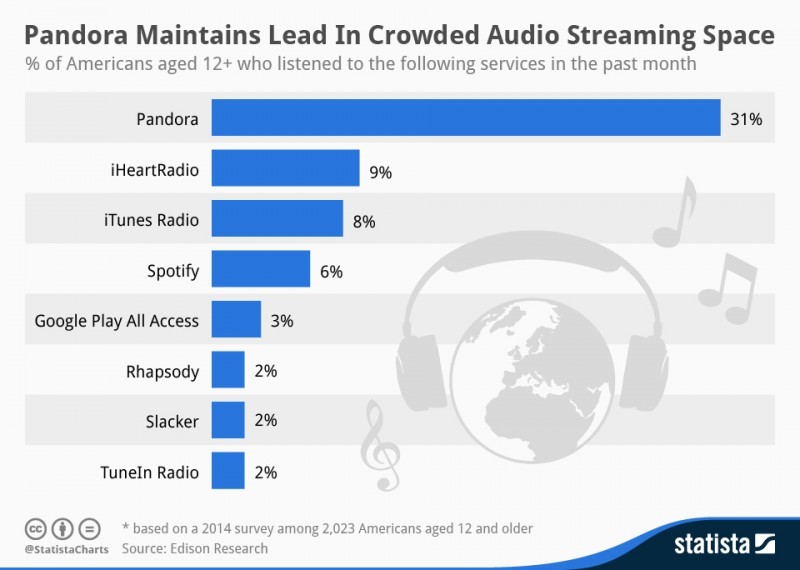

iHeart – Australian Radio Network: Features personalised radio, streaming and aggregates ARN (and Clear Channel) radio brands. ARN recently signed a 10 year licence with Clear Channel’s iHeart. It was founded in 2008 and has over 30 million users. It's a free service and is number two with a 9% share.*

Songl – Southern Cross Austereo: Has personalised playlists and also aggregates SCA brands 2Day, Triple M and four digitals Buddha, Stardust, Loveland and Classic Rock. Songl is an Australian-owned, on-demand service, is subscription-based and also has a light ad-supported free version, charging $12.99 a month. It’s had 147,000 registrations in its first 10 months. SCA also has a small minority stake in Omny, a mobile platform which allows local users to choose talent shows as well as music, news, sport and other content. Omny is one of the first to market talent aggregators.

Songl – Southern Cross Austereo: Has personalised playlists and also aggregates SCA brands 2Day, Triple M and four digitals Buddha, Stardust, Loveland and Classic Rock. Songl is an Australian-owned, on-demand service, is subscription-based and also has a light ad-supported free version, charging $12.99 a month. It’s had 147,000 registrations in its first 10 months. SCA also has a small minority stake in Omny, a mobile platform which allows local users to choose talent shows as well as music, news, sport and other content. Omny is one of the first to market talent aggregators.

.jpg) Rdio – Nova Entertainment: Again offers personalised digital music, but unlike iHeart and Songl, interestingly doesn’t aggregate the radio brands Nova and smooth. Founded by the co-creator of Skype, it’s now in over 60 countries and is subscription-based with a $9.99 monthly charge. Rdio doesn’t disclose its user numbers, but is said to have a couple of hundred thousand subscribers.

Rdio – Nova Entertainment: Again offers personalised digital music, but unlike iHeart and Songl, interestingly doesn’t aggregate the radio brands Nova and smooth. Founded by the co-creator of Skype, it’s now in over 60 countries and is subscription-based with a $9.99 monthly charge. Rdio doesn’t disclose its user numbers, but is said to have a couple of hundred thousand subscribers.

User numbers for the various services can be vague and you need to compare registered users versus paid subscribers. Some companies don't disclose numbers at all.

The ABC currently has a Radio Player in Beta format which will replace all live and on-demand audio players across ABC Radio. You can currently get a sneak peek of the ABC’s offering.

A colleague and I were discussing a concept recently: “Wouldn't it be great if you could select all your favourite talent shows and have them on one channel?" So, you could listen to Amanda & Jonesy at breakfast, Meshel & Tommy in mornings, Fifi & Dave in the afternoon, Chrissie & Jane in drive, Kyle and Jackie O at night and Kate,  Tim and Marty late nights. The best of the great talent shows all on one stream. All time shifted. That has to be the next step.

Tim and Marty late nights. The best of the great talent shows all on one stream. All time shifted. That has to be the next step.

The future is already partly here with a couple of services. Stitcher is an on-demand internet radio service that focuses on news, information and podcasts. Stitcher aggregates content from thousands of content providers and organises the content into "stations" that listeners can browse and listen to.

And Omny, the platform which allows users to choose talent show segments, featuring a library of shows from Southern Cross Austereo and also podcasts from the web and a select catalogue from around the world, (but naturally doesn't include shows from competing networks ARN and Nova Entertainment).

And Omny, the platform which allows users to choose talent show segments, featuring a library of shows from Southern Cross Austereo and also podcasts from the web and a select catalogue from around the world, (but naturally doesn't include shows from competing networks ARN and Nova Entertainment).

The next step is a platform that aggregates talent content from all networks around the country. It would be a matter of licensing the rights from all the radio groups. Apple did it with music on iTunes by licensing all of the competing record companies catalogue, selling from the one platform. And in subscription television, the Foxtel guide aggregates the Foxtel channels and also the free-to-air channels.

Personalized platforms are now just starting to provide more than just music. They are starting to bring to market one of the key, unique attributes of broadcast radio, the talent shows, on demand.

Australia’s commercial radio giants compete with the other personalised radio platforms from around the world. They include:

Pandora – the leading, free music recommendation service which is free. Launched in the US in 2000 and Australia in 2012 Pandora peronalisation starts with a ‘seed’ song or genre, using their propriety music-matching program ‘The Music Gerome Project‘. Pandora has over 77 million users** and revenues in excess of ½ billion. It has a 31% market share* and is ad-supported, charging US$3.99 monthly. Pandora is said to be adding news and talent shows at some stage.** May 2014

iRadio – Launched this year by Apple, iTunes radio is an ad subscription service charging $34.99 a year and has over 20 million users. It is number three in the market with an 8% share. *Apple was the company that turned digital music into a mainstream phenomenon.

iRadio – Launched this year by Apple, iTunes radio is an ad subscription service charging $34.99 a year and has over 20 million users. It is number three in the market with an 8% share. *Apple was the company that turned digital music into a mainstream phenomenon.

Spotify – has more than 40 million active users and over 10 million paid subscriptions. It's a combination of free-service and an ad-supported premium or basic service. It has a 6% market share and is number four in the market. * Launched in Australia 2012.

Spotify – has more than 40 million active users and over 10 million paid subscriptions. It's a combination of free-service and an ad-supported premium or basic service. It has a 6% market share and is number four in the market. * Launched in Australia 2012.

TuneIn – claims 50 million monthly active users around the world. It aggregates and streams audio of thousands of radio networks and stations around the world. It’s promoted as ‘real’ radio and is a free service that has a 2% share.*

TuneIn – claims 50 million monthly active users around the world. It aggregates and streams audio of thousands of radio networks and stations around the world. It’s promoted as ‘real’ radio and is a free service that has a 2% share.*

Beats Music – Launched early this year and subscribers are estimated at only around 200,000. Its estimated revenue is somewhere between $50 and $100 million. The Beats Apple $3billion deal makes it a very powerful force, though most are still tipping that Pandora will remain leader. Beats costs users $9.99 a month, but Apple could now market the Beats music service at a loss putting pressure on leaders Pandora and Spotify.

Beats Music – Launched early this year and subscribers are estimated at only around 200,000. Its estimated revenue is somewhere between $50 and $100 million. The Beats Apple $3billion deal makes it a very powerful force, though most are still tipping that Pandora will remain leader. Beats costs users $9.99 a month, but Apple could now market the Beats music service at a loss putting pressure on leaders Pandora and Spotify.

Google Play – offers an online music store, cloud storage and boasts over 50 billion downloads. Storage is free and the charge is $9.99 monthly. It has a 3% market share in music *

Unlimited – the offering from Sony, originally branded as the Qriocity, driven largely by Playstation. It has more than a million active users and over 20 million songs. No free service, it has a $4.99 per month service with ads or $9.99 without.

Deezer – based out of France, it claims over five million paid subscribers. Has basic plan or $6.99 supported by ads or premium service for $11.99. Deezer has started to consolidate, closing their local office recently to reduce costs and focus on the US market.

Deezer – based out of France, it claims over five million paid subscribers. Has basic plan or $6.99 supported by ads or premium service for $11.99. Deezer has started to consolidate, closing their local office recently to reduce costs and focus on the US market.

Xbox – from Microsoft, has sold over 77.2 million consoles worldwide. Features streaming services as well as gaming, applications and online services. Charges $11.99 per month for its premium service.

Soundcloud – where you can upload, record, promote and share originally created content. Now has 40 million registered users and 200 million users.

Soundcloud – where you can upload, record, promote and share originally created content. Now has 40 million registered users and 200 million users.

Grooveshark – its catalogue streams over one billion sound files per month, contains over 15 million songs and has 20 million users. It’s ad-supported and charges US$9 monthly. Its service is legally unclear however, and has been sued by all four major music labels (the cases have not yet resolved).

Grooveshark – its catalogue streams over one billion sound files per month, contains over 15 million songs and has 20 million users. It’s ad-supported and charges US$9 monthly. Its service is legally unclear however, and has been sued by all four major music labels (the cases have not yet resolved).

Last.fm – One of the oldest services still in existence, Last.fm is a free, no-ads service, a ‘music recommendation tool’ that keeps track of everything you’ve listened to. It also has a $3 month premium service. Last.fm closed its radio streaming earlier this year.

Last.fm – One of the oldest services still in existence, Last.fm is a free, no-ads service, a ‘music recommendation tool’ that keeps track of everything you’ve listened to. It also has a $3 month premium service. Last.fm closed its radio streaming earlier this year.

Slacker – allows users to create and share customized music stations. It has over 30 million users with a 2% market share.*

Myspace Music – recently re-positioned away from being social media and now runs as a music platform. Myspace receives over 26 million unique users each month

Rhapsody – One of the earliest, from Seattle, and originally called Aladdin. Rhapsody is subscription-only and charges $9.99 a month. It currently has a 2% share* and is more a digital ‘locker service’ than radio streaming.

Rhapsody – One of the earliest, from Seattle, and originally called Aladdin. Rhapsody is subscription-only and charges $9.99 a month. It currently has a 2% share* and is more a digital ‘locker service’ than radio streaming.

Radiomony – a free global service that allows users to create their own radio online. The platform provides its members with the necessary tools to disseminate, promote and monetise their free radio. Now has over 60,000 stations.

Radiomony – a free global service that allows users to create their own radio online. The platform provides its members with the necessary tools to disseminate, promote and monetise their free radio. Now has over 60,000 stations.

Amazon – the online retailer has been in talks about having a streaming music subscription service to attach to their premium ‘Prime’ position. Owns the ‘book seller’ position currently. After losing money in 2012, last year the company made a profit of US$349 million on revenue of US$75 billion!

Amazon – the online retailer has been in talks about having a streaming music subscription service to attach to their premium ‘Prime’ position. Owns the ‘book seller’ position currently. After losing money in 2012, last year the company made a profit of US$349 million on revenue of US$75 billion!

Mixcloud – specialises in DJ remixes, it lets users browse and stream audio content uploaded onto its site. Radio shows, DJ remixes and podcasts are available.

8tracks – is crowd-sourced, people-powered curated playlists where you can create playlists by mood, era, genre or your activity at the time. It was launched in 2008 and costs $25 for a six month subscription.

8tracks – is crowd-sourced, people-powered curated playlists where you can create playlists by mood, era, genre or your activity at the time. It was launched in 2008 and costs $25 for a six month subscription.

Bloom.fm – The UK music-streaming service recently shut down after its main investor suddenly pulled out. It had signed over 1.1 million users.

Bloom.fm – The UK music-streaming service recently shut down after its main investor suddenly pulled out. It had signed over 1.1 million users.

There are countless other streaming services and music platforms, providing competition for music services with radio. The big difference being radio offers a great deal more than just music and it’s simple to use. Music is only one component of broadcast radio content which also includes local news and information, talkback callers, entertainment, production, promotions, personalities and talent shows, with localism being a key factor. Broadcast radio is still the easy, local, ultimate one stop shop for listeners.

Some platforms already run commercials like broadcast radio does, with some looking to ‘localise’ as they attempt to get closer to traditional radio.

There are now lots of defunct digital music services including Bloom.fm, Connect, Turntable.fm, Broadcast.com, Stripe, Liquid Audio, Yahoo Music, of course Napster and many more.

The really big question is can these businesses actually make money?

Andrew Shelley, Chief Analyst and Generator Research Director, wrote recently: “Our analysis is that no current music subscription service, including marquee brands like Pandora, Spotify, and Rhapsody can ever be profitable, even if they execute perfectly.”

So, there will probably be a shake out at some stage. Personalised radio platforms and streaming services seem be in a ‘dot com’ or ‘tech’ bubble of their own right now and we know what happened last time in 2000. Share prices, of course, are investors view of future profits and in the case of digital platforms often based on revenue rather than profit.

With up to 70 percent of the money from music platforms going to the record labels who hold the music licences, it’s going to be a challenge to actually make money. The other big costs being bandwidth and streaming costs, which rise as the services attract more users.

Some services around today will survive and thrive, others wont .The greatest challenge being the vast amounts of capital to feed continual growth and being able to generate and sustain profits in an increasingly competitive landscape. In the online/digital environment only the ‘big guns’ can possibly be expected to do well in the future.

Consolidation will continue until there are just two to three category leaders dominating, perhaps with some smaller niche or extremely differentiated services meeting a specific need.

Personalisation is brilliant, but consumers are time poor. There is a general trend towards outsourcing in consumer’s lifestyles in general. So, there is a strong case for listeners outsourcing the programming and letting the experts, the radio programmers, do the work. Broadcast radio is programmed using music and perceptual research by real people, experienced programmers, not algorithms!

One of the reasons Apple acquired Beats, apart from the charismatic leadership of Jimmy Iovine and Dr Dre and its ‘hipness’ was that Beats Music is curated by tastemakers and professional music programmers and not just machines as is the case of a lot of other services.

One of the reasons Apple acquired Beats, apart from the charismatic leadership of Jimmy Iovine and Dr Dre and its ‘hipness’ was that Beats Music is curated by tastemakers and professional music programmers and not just machines as is the case of a lot of other services.

There remains no better way to reach a mass audience with trust, quality, and credibility than broadcast radio. Generally those in the broadcast radio business do not propose a broadcast or digital-only model. Instead believing in an integrated model, where digital and broadcast radio collaborate to provide consumers with great experiences. That's the way of the future.

Insights from McKinsey’s consumer research** shows a big divide with under-35 youth and the older consumers aged 35-64. The drop off starts at around age 30, hence the future challenge for broadcast radio with younger listeners.

McKinsey’s research reveals that ‘youths’ lead digital lives. They don’t buy PCs or Laptops anymore, preferring smartphones and tablets. They clearly lead the way in adopting new digital services.

As the world further digitises the original leading brands like Microsoft, Sony and Yahoo don't resonate anymore with youths like Apple, Google or Beats do.

Online and personalised radio isn’t going away. It’s a huge part of our future. These platforms will be part of the ever-expanding competitive radio landscape providing a myriad of choice for consumers.

Broadcast radio will remain strong with online music platforms now paving the way for the future. And the two can co-exist very well together for a very long time to come.

*source:

**source McKinsey’s iCommerce research 2013

Brad March is a Director of Radio Today, is a former CEO and Group Program Director of Austereo and has been named Media Executive of the Year

|

|

|