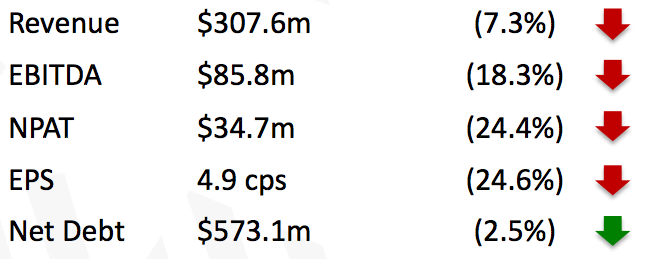

SCA earnings fall by 25%

.jpg)

Southern Cross Austereo have announced their interim financial results for the 6 months to 31 December this morning, with a presentation to investors about to commence in Sydney.

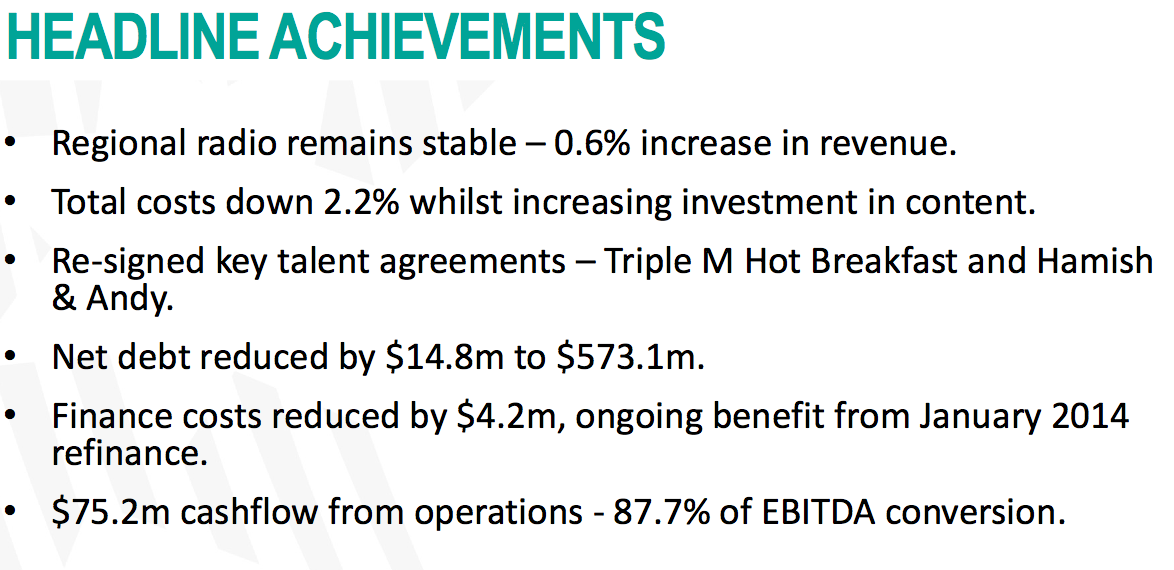

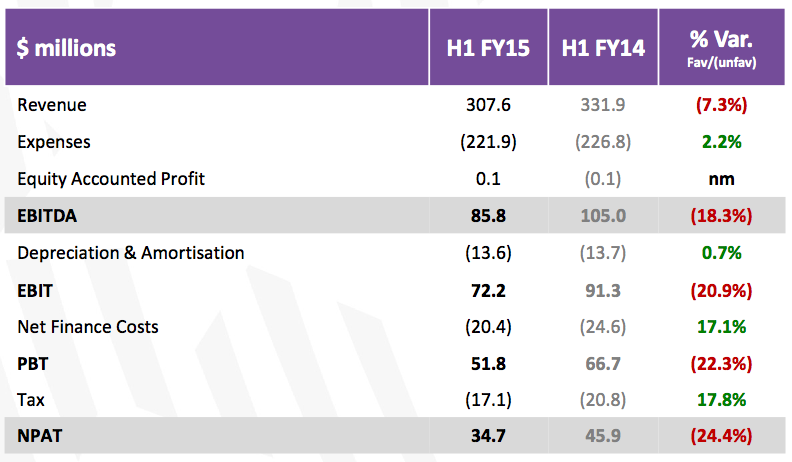

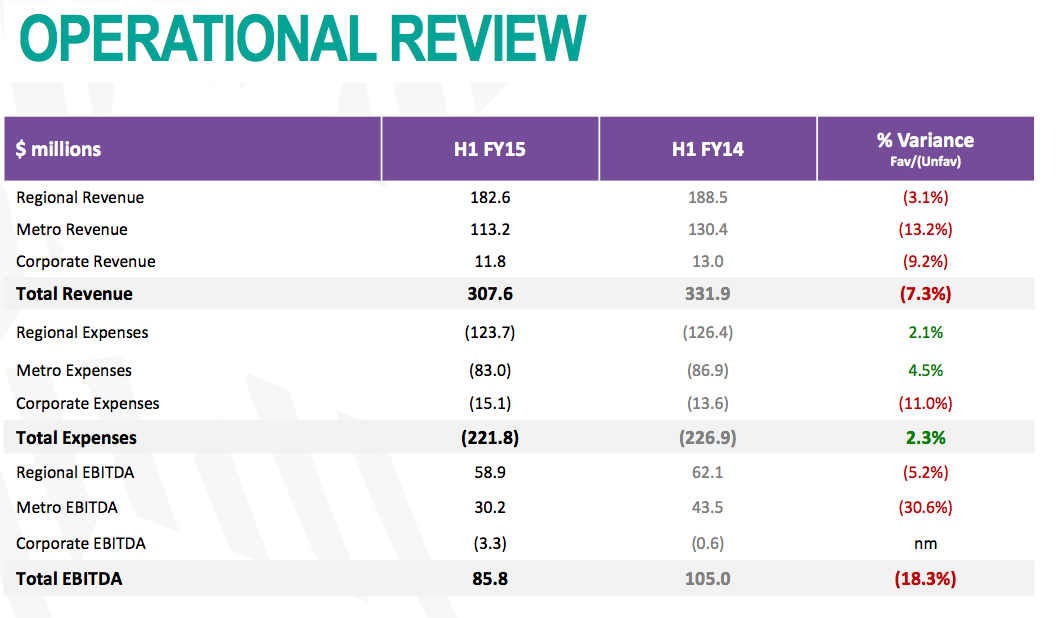

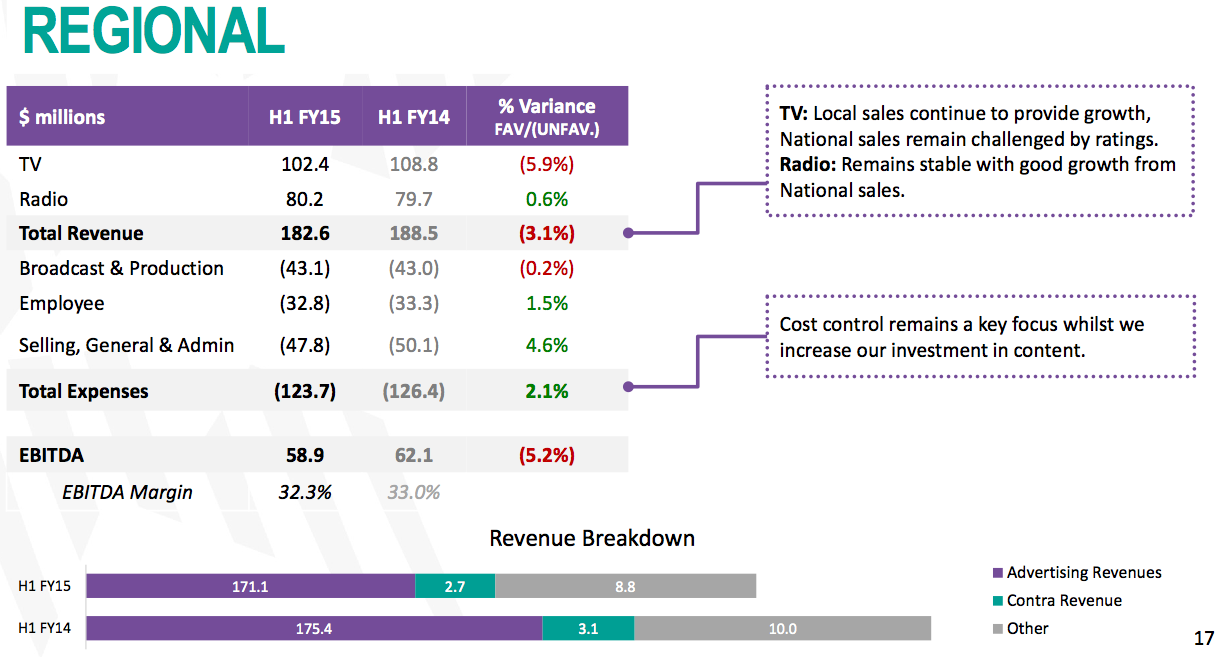

Whilst the company had prepared the market for a softening, in October offering guidance of EBITDA decline of 18-20%, the actual decline in revenue and earnings is nonetheless steep.

Group revenue has declined by 7.3% to $307.6m, EBITDA has declined 18.3% to $85.3m, and Net Profit after Tax is down 24.4% to $34.7m.

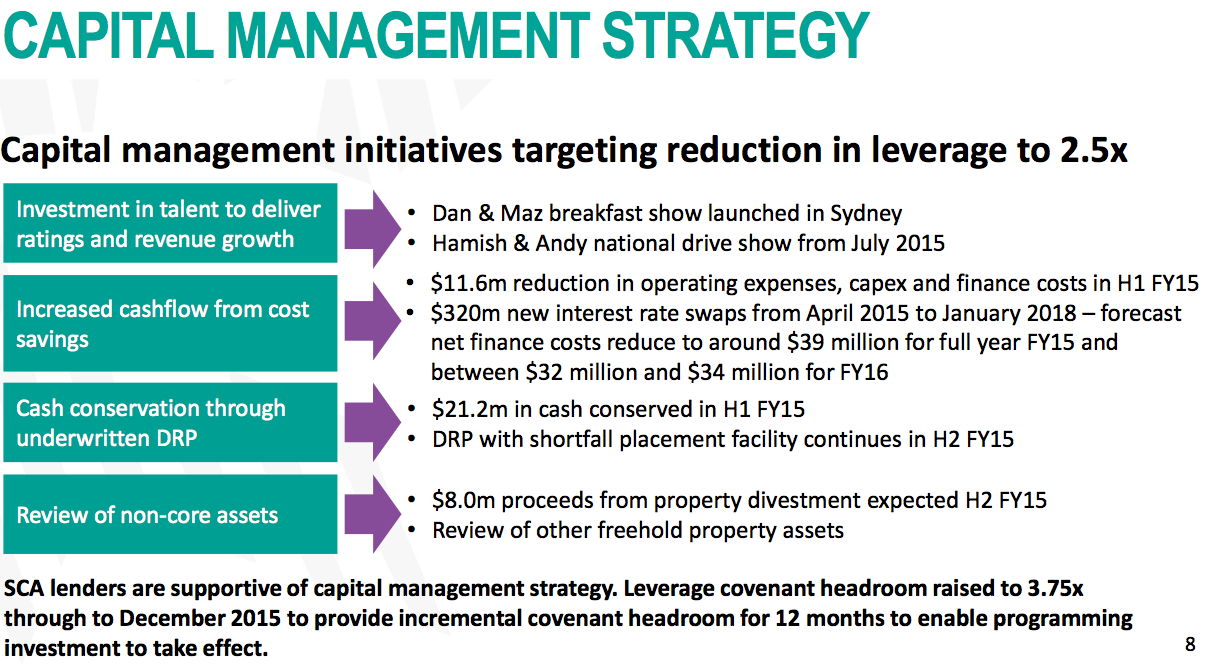

The net debt for SCA has declined marginally to $573m, although SCA has been clear that they remain well within debt covenants at this time.

CEO Rhys Holleran has commented:

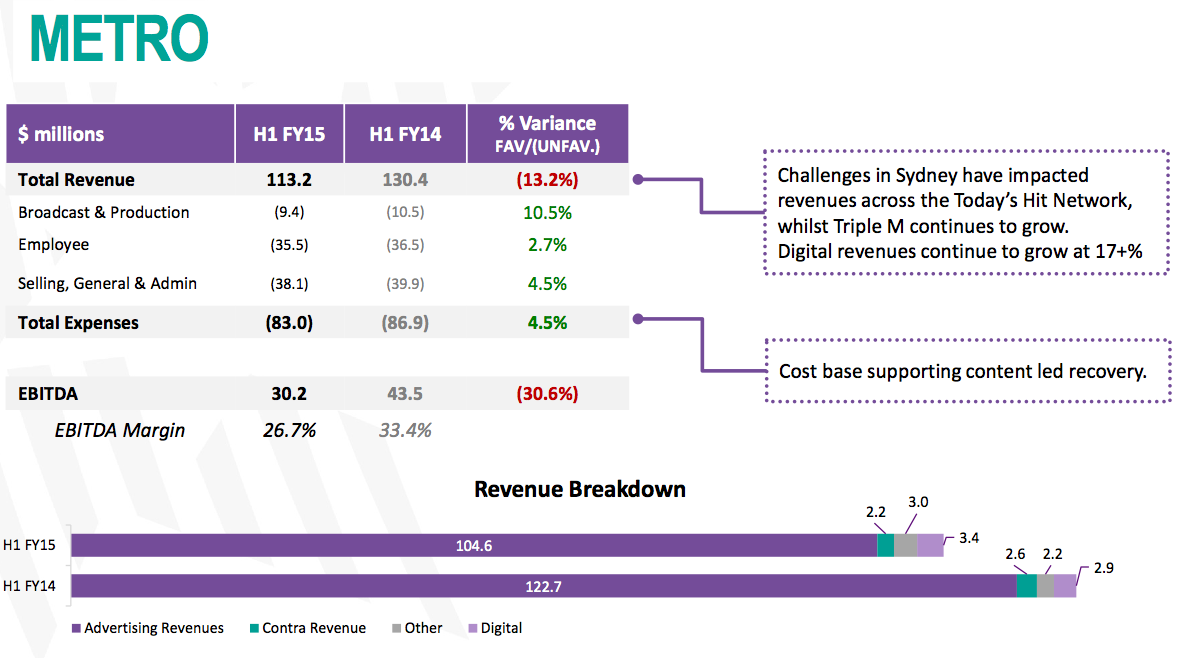

“The first half results for FY 2015 reflect challenging conditions in television advertising markets and a reduced metro radio market share.

“The first half results for FY 2015 reflect challenging conditions in television advertising markets and a reduced metro radio market share.

In 2015, we are strengthened by the talent line ups in metro radio and are confident that the strategic direction of the company and the focus on debt reduction will put the company in a sound position to improve over this financial year and the next.”

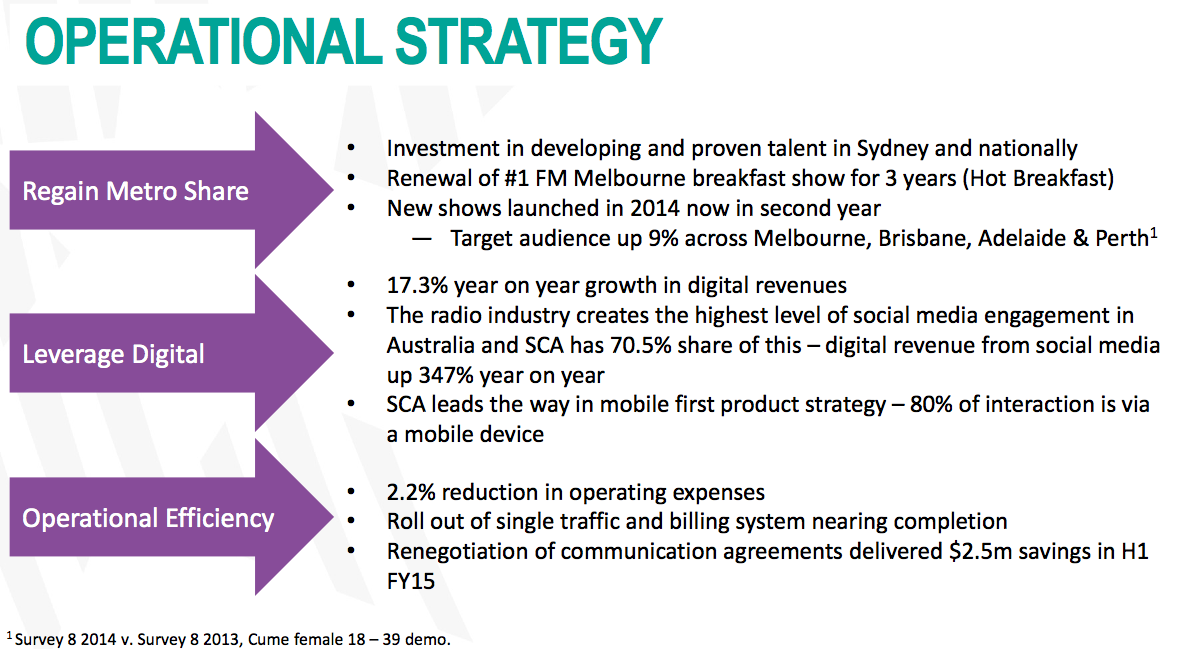

The financial report has focused on the future, outlining what they have called a 'content led recovery', with 'Dan & Maz' and 'Hamish & Andy' being highlighted as the keys to the refresh of the Today brand.

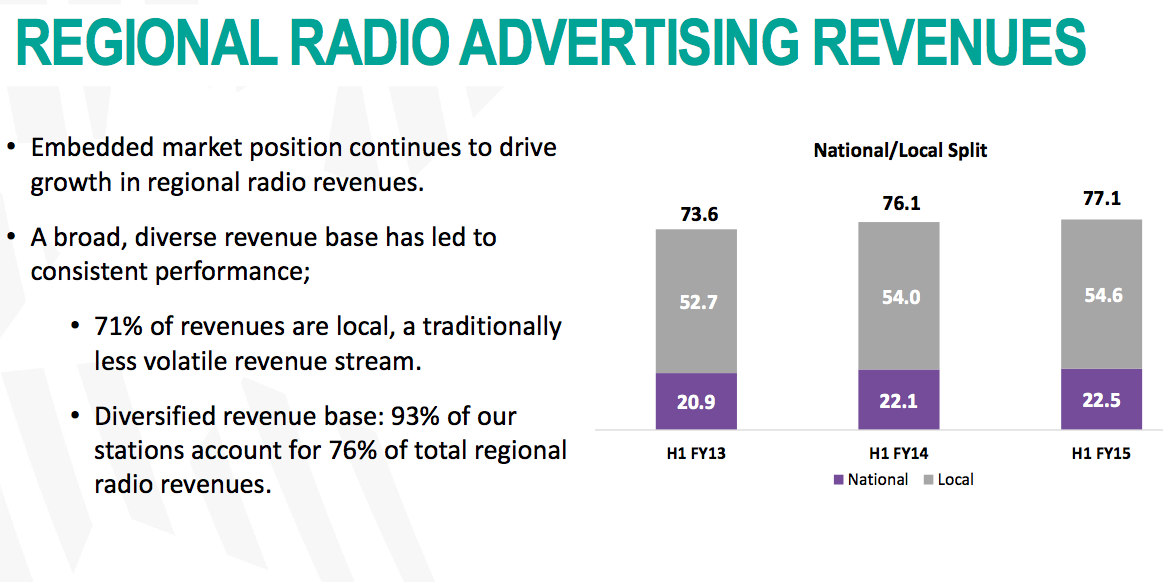

Unsurprisingly, 2Day FM's performance is responsible for the majority of the (radio) revenue decline. Whilst the Today Network revenue fell overall by 33%, when 2Day is excluded from that calculation, the revenues are down 3.4%, outlining the severity of the impact 2Day's performance has had on the business.

Bush is currently Chairman of Pacific Brands, the Mantra Group, and has served on the boards of Nine Entertainment, Insurance Group Australia, McDonalds and Lion Nathan.

Bush said: "Media is undoubtedly one of the most dynamic of all industries, made more so by the range of challenges and opportunities prevailing today.

(SCA) is extremely well situated to meet both the challenges and opportunities, making this role just too good to refuse".

Below are a number of slides from today's SCA investor presentation.