Profits for ARN’s parent HT&E down 52%, but company says it has emerged ‘stronger’ from pandemic

The parent company of the Australian Radio Network (ARN), HT&E, has revealed its full-year financials for the 2020 calendar year.

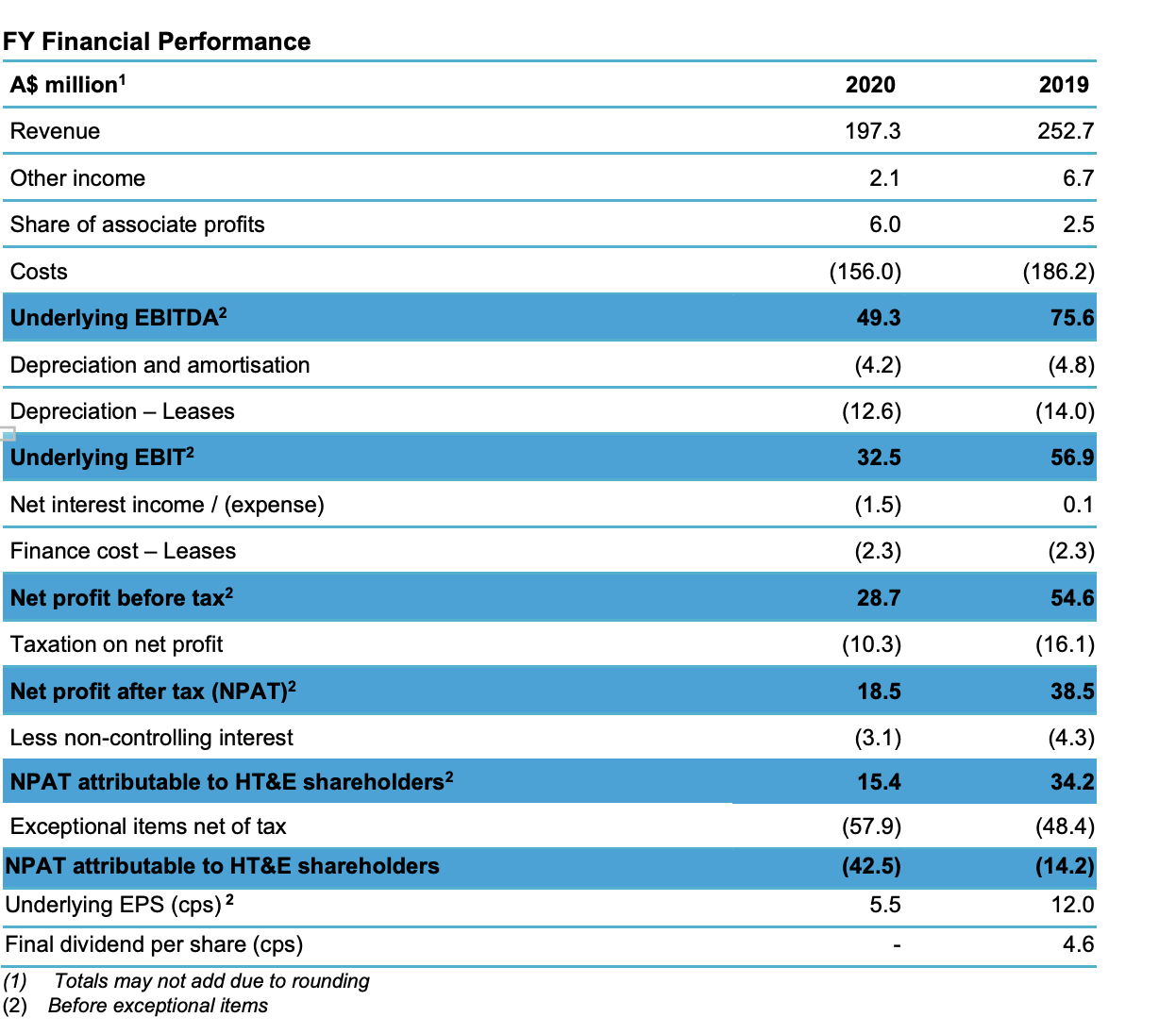

The company’s revenue for the full 2020 calendar year was $197.3 million, down 21.9% from 2019’s $252.7 million. Costs, however, also fell 16.2% from $186.2 million in 2019 to $156 million.

Its underlying EBITDA (earnings before interest, tax, depreciation and amortisation), before exceptional items, such as the costs associated with restructuring and disposing of businesses, was $49.3 million, down almost 35% from $75.6 million.

Its net profit after tax, excluding exceptional items was $18.5 million, down 52% from 2019’s $38.5 million.

The company confirmed it had benefited from $10.3 million in JobKeeper payment between March and September. In the June quarter, revenues were back 46% on the year prior, however by September the company was no longer eligible for the JobKeeper subsidy, which requires a year-on-year drop of 30% in revenue.

As part of HT&E’s cost management response to COVID-19, executives forwent their 2020 incentive payments. CEO and managing director Ciaran Davis thus had a total package of $1.197 million, down from 2019’s $1.717 million. With Vested TIP (total incentive plan) payouts, Davis’ package in 2020 was $1.222 million, down from 2019’s $2.294 million.

There was also $13.0 million in one-off savings for the business in 2020.

Payments to suppliers and employees were down to $177.889 million from $221.173 million (a decline of almost 20%). Employee benefits scheme payments were down from $98.928 million to $91.945 million.

And despite the COVID-19-related redundancies of 2020, which the company said hit about 5% of its workforce, redundancies and associated costs were actually down almost 70% from $4.802 million in 2019 to $1.458 million last year.

Selling and marketing expenses were also down from $39.253 million to $28.806 million. Travel and entertainment costs also fell from $2.894 million to $1.104 million.

HT&E said in a difficult year, complete with a global pandemic, an advertising recession and staff cuts, it had emerged stronger.

“HT&E navigated the period well and has maintained its strategic focus during the year, strengthening our core Australian radio operations, further investing in digital audio, as well as building further balance sheet strength, providing optionality in a consolidating market,” HT&E chairman, Hamish McLennan, said.

“ARN remains the best-performing audio company in Australia, both commercially and in ratings, delivering advertisers integrated unique and engaging content from some of the world’s best talent across radio, music streaming and podcasting.”

He also noted the company’s investment in outdoor giant oOh!media, now helmed by former NOVA Entertainment CEO Cathy O’Connor, has more than doubled its initial value. The company paid $18.1 million for a 4.7% stake in the first half of the year.

CEO and managing director of HT&E and ARN, Davis, was emphatic about the company’s achievements in difficult circumstances.

“Despite the extraordinary disruption to our business due to the pandemic, ARN maintained its position as the #1 metropolitan network in Australia, and continued to take commercial market share,” he said. “We are building momentum in our digital audio transformation as extraordinary growth of digital listening saw a 14% growth in iHeartRadio app downloads, and a 19% growth in registered users to 1.9 million.

“What we achieved in 2020 demonstrates HT&E’s leadership in the Australian audio market. In a year that was rewritten history, Australian audiences have made ARN and iHeartRadio podcast brands the number one choice for audio content, delivering consistency and certainty for our commercial clients. I am confident that the momentum that we have built will continue in 2021 as we focus on creating the leading audio entertainment business in Australia.”

The company said the outlook for 2021 is positive, with Q1 (January to March) potentially finishing flat with last year and encouraging signs for April and Q2 campaigns with ARN.

It said it was reinvesting to drive growth by improving its digital and data capabilities, digital audio and podcast development and the marketing of its brands. Should the advertising market recovery continue, HT&E said total people and operating costs for 2021 should be in line with 2019.

HT&E’s report to the ASX also noted 51% of its workforce is female, while only 25% of senior management is. With the addition of senior management’s direct reports, this climbs to 33%, down from 35% in 2019.

Its board is 20% female, which falls short of ASX Recommendation 1.5 for ASX 300 entities. The ASX recommends a measurable objective for gender diversity in the composition of the board of no less than 30%.

HT&E said it had processes and policies in place to facilitate an increase in the ratio of women in management roles, however its reviews into key work groups to identify and correct any potential barriers to the promotion of women was “ongoing”.

The detailed financials are below.